Our Story Begins

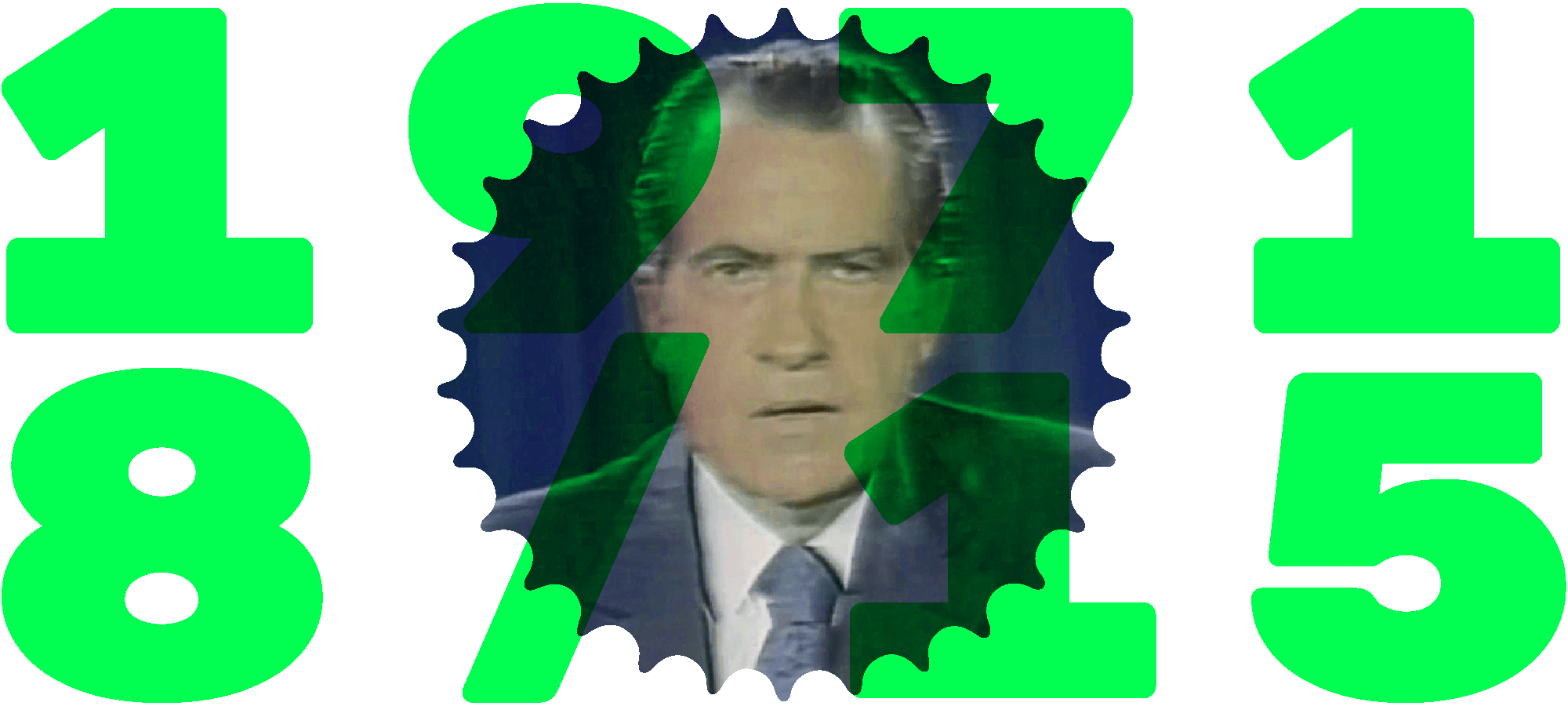

In August 1971 the US government refused to give European central banks gold owed to them. The euro was set up to ensure this would not happen again.

This post is for paying subscribers only

Already have an account? Sign in.