Follow The Giants

Purchases, repatriations, audits … Major central banks are demonstrating ownership of physical gold.

Central banks are the most powerful actors in the global monetary system. They decide what money is, what it's not, and how much circulates.

As the major buyers and sellers, central banks control the gold market. At this point in economic history, it might be wise for investors to follow what the “sovereign whales” are – buying gold aggressively and repeatedly.

2023 updates:

China Still Buying …

2023-04-07 — China boosted its gold reserves for a fifth straight month, extending efforts by the world’s central banks to boost their holdings of the precious metal.

- The People’s Bank of China raised its holdings by about 18 tons in March, according to data on its website.

- Total stockpiles now sit at about 2,068 tons, after growing by about 102 tons in the four months before March.

Singapore buys gold

2023-04-28 — Krishan Gopaul reports that Latest data from the Monetary Authority of Singapore shows their gold reserves increased by 17.3 tonnes in March. This means they have bought 68.7 tonnes of gold in Q1'23, lifting gold reserves to 222.4 tonnes (45% higher than at the end of December).

Czech National Bank buys

2023-04-20 — Gold reserves at the Czech National Bank increased by 1.5 tonnes in March according the latest IMF IFS data. This follows an 1.4 tonne increase in 2022. Total gold reserves now total 13.5 tonnes, the highest level since mid-2006.

Iran removes restrictions on gold imports

2023-01-29 — The Central Bank of Iran lifts restrictions on importing gold, effective immediately (January 29th).

- Requirement for Letter of Credit for gold import was removed

- Importers can import gold using any means of payment

- Restrictions on the use of importer's forex for gold imports also removed

BRICS undermine dollar hegemony with gold purchases

2023-01-10 — Central banks have been accumulating the precious metal at a record rate:

It seems unlikely that the countries buying gold are going to try to give their currencies gold backing. But it appears probable that the immediate cause of the rush for gold is an attempt to diversify out of dollars. Since the United States seized Russia’s dollar reserves after the invasion of Ukraine last year, other countries have grown distrustful of holding dollars as they fear that they, too, could see their reserves seized in the future. Hence the race for gold.

2022 updates:

Australia’s SWF buys gold, commodities as inflation looms

2022-12-18 — Australia’s A$200 billion ($134.28 billion) sovereign wealth fund is increasing exposure to gold, commodities, private equity and infrastructure as it warns the future will echo the low-growth, high-inflation era of the 1970s.

China confirms it is mystery, gold-buying 'whale'

2022-12-07 — In November there was speculation about the "mystery" buyer who bought 300 tons of gold – roughly three-quarters of what would be a record 399 tons of central bank gold purchases in late 2022.

Now The People's Bank of China has reported an increase in its gold reserves for the first time in more than three years, confirming that they were indeed the mystery buyer behind the huge gold purchases.

Qatar keeps buying

2022-12 — The Qatar Central Bank added another 2.6 tonnes of gold to reserves during November, and now holds 91.5 tonnes of monetary gold.

Turkey, Uzbekistan continue to buy gold

2022-11-03 — The central banks of Uzbekistan and Turkey lead recent central bank gold purchases:

- The Central Bank of the Republic of Uzbekistan bought 8.7 tons of gold in October, the fifth straight month where they've purchased that amount – lifting YTD net purchases to 37 tons, and total gold reserves to 399 tons.

- The Central Bank of Turkey bought 9 tonnes of gold last month, "lifting YTD net gold purchases to 103 tonnes. Total official gold reserves now total 498 tonnes.

Vietnam triples gold demand

2022-11-07 — "Vietnam's gold demand more than tripled to 12 tons in Q3 from 3.3 tons a year earlier. Bullion and coin sales rose to 8.5 tons from 2.4 tons, and jewelry sales to 3.5 tons from 0.9 tons, according to a report by the World Gold Council."

Central banks buy a record amount of gold 2022

2022-11-01 — Bloomberg [🔒]:

Central banks bought a record amount of gold last quarter as they diversified FX reserves, with a large chunk of the purchases coming from as-yet unknown buyers.

Almost 400 tons were scooped up by central banks in the third quarter, more than quadruple the amount a year earlier. That takes the total so far this year to the highest since 1967, when the dollar was still backed by the metal.

Portugal's central bank declares gold the 'only' reserve asset

2022-10-26 — Central bank of Portugal:

Gold is the only reserve asset that is free from political and credit risk.

Qatar builds gold reserves to new record

2022-08-23 — The Central Bank of Qatar added 14.8t of #gold to its official reserves in July 2022. This appears to be the largest monthly increase on record (back to 1967), although early data is patchy. Gold reserves now stand at 72.3t, the highest on record. [Data via IMF IFS]

India launches first bullion exchange

2022-07-29 – India launches its first international gold bullion exchange in order to bring transparency to markets. Market analyst Luke Gromen adds [🔒]:

On its own, the gold announcement is interesting; when paired with the mechanisms for international trade settlement in INR (Indian rupees) that the Reserve Bank of India (RBI) announced two weeks ago, the announcement above becomes orders of magnitude more interesting – is India considering using gold to settle INR-denominated trade deficits (which would likely require a “more transparent” (i.e., higher) gold price, since oil markets are some 10-15x bigger than physical gold markets)?

Nigeria launches gold-trading exchange

2022-07-26 – Lagos Commodities and Futures Exchange (LCFE) prepares to commence gold trading on the inaugural Pan-African Commodities Exchange.

Iraq is buying

2022-06-30 - The Central Bank of Iraq (CBI) announced a 34-tonne increase in gold reserves. This is their first significant gold purchase for three years and brings their reserves to just over 130 tonnes.

Via Krishnan Gopaul

Austria's strange repatriation delay

2022-06-02 – An odd story: Oesterreichische Nationalbank (Austria's central bank) is seven years behind in its plan to move 50 tonnes of monetary gold from London. In an email statement to journalist Jan Nieuwenhuijs, they wrote:

We can confirm that the relocation has been postponed. However, we are not allowed to disclose any details in order to comply with contractual obligations to keep business secrets of external partners involved.

Earlier this year the London Metal Exchange (LME) suspended nickel trading and cancelled deals worth billions of dollars, raising questions about its ability to run an orderly market. Could something similar be brewing in the gold market?

The Czech Republic buys

2022-05-25 – Ales Michl, the Czech Central Bank's incoming governor, intends to sharply increase their gold reserve holdings – from 11 to 100 tonnes or more. [via @goldseek]

Turkey wants its citizens' gold

2022-05-17 – Turkish President Recep Tayyip Erdoğan announced that cheaper housing loans will be provided to those who convert their foreign exchange savings to Turkish lira or sell their gold to the central bank to use in purchases of houses worth up to TL 2 million ($127,150).

Kazakhstan is buying

2022-05-16 – According to Krishan Gopaul of the World Gold Council: The Central Bank of Kazakhstan added 5.3 tonnes to its official gold reserves in April. Their gold reserves now total 373 tonnes.

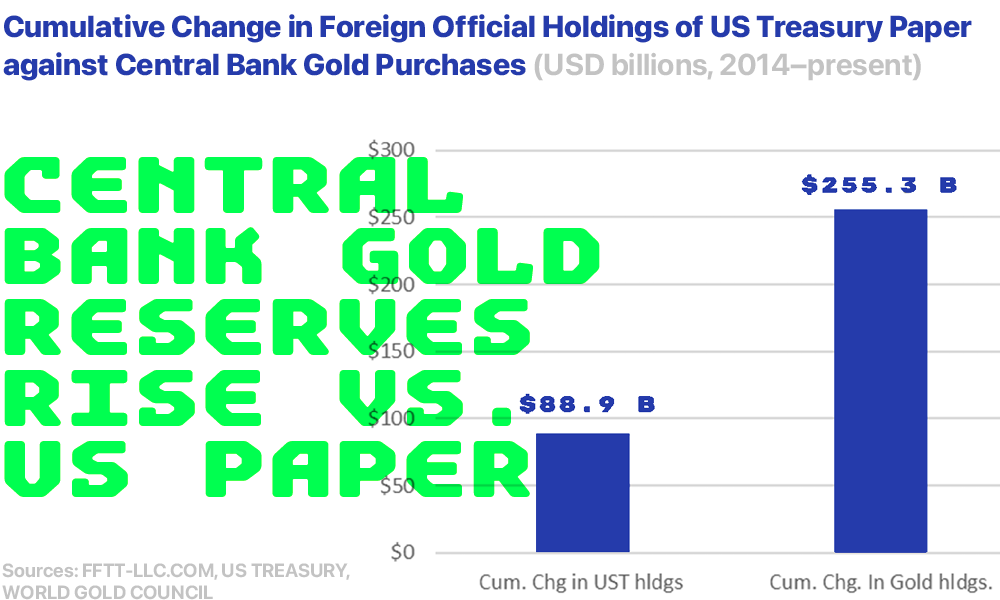

Gold replaces US Treasury paper

2022-04-19 – "Nothing will replace the US dollar. Gold has been replacing US Treasury paper as the primary global reserve asset since shortly after the Great Financial Crisis" —Luke Gromen

Egypt is buying

2022-04-11 – Latest data from the IMF shows that the Central Bank of Egypt increased its #gold reserves by 44t (+54%) in February. Their gold reserves now total 125t.

Australia audits gold held in London

2022-04-07 – A senior Reserve Bank of Australia official will travel to London to check that Australia’s 80 tonnes of gold bullion are still in Bank of England’s vaults. The BoE holds about 6400 bars on behalf of the RBA, worth about $6 billion.

Russia offers to buy

2022-03-23 – Bank of Russia offers to buy gold in domestic market at 5,000 rubles per gram. With a gram of gold trading then at ~$62 (this implies a RUB/USD rate of around 80.6), RUB/USD has quickly moved up towards this level, strengthening the currency.

Gold revalued?

2022-02-15 – Deutsche Bundesbank (Germany's central bank) does not rule out gold revaluation: "The more debt accumulated on the balance sheets of European central banks, the more likely they will revalue gold to write off this debt."

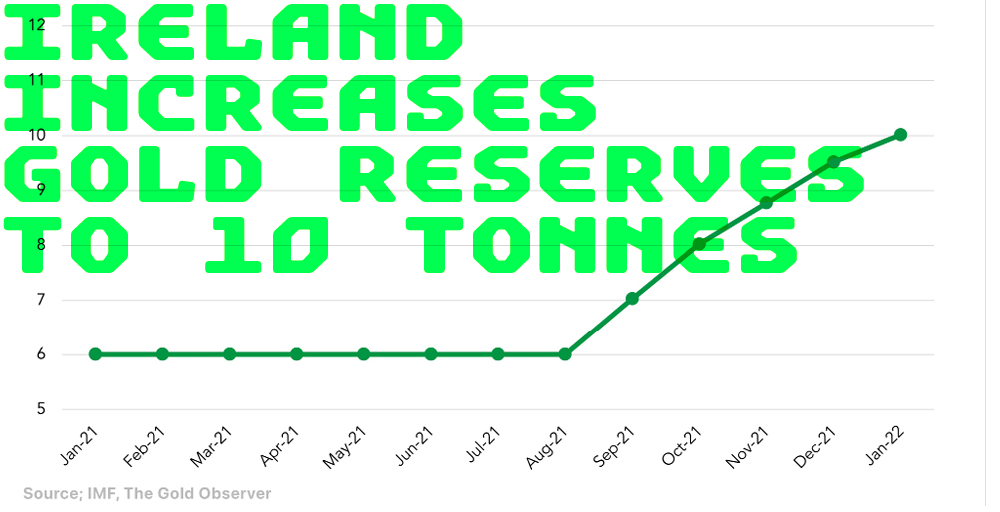

Ireland is buying

2022-01-07 – The Central Bank of Ireland purchased half a tonne of monetary gold in January 2022. An increase of 67% over five months pushed their gold reserves to more than 10 tonnes.

Pre-2022:

Brazil increases holdings

2021–07-15 — Gold holdings belonging to Banco Central do Brasil (The Central Bank of Brazil) rose more than 100% in three months. Brazil’s Central Bank refuses to answer any questions about its Gold Reserves (bullionstar.com)

Central banks buy more

2021-06-21 – The world's central banks bought a net 32 tonnes of gold in June. Brazil was by far the bigger buyer in the month, and several other central banks were active.

Ghana buys to bolster reserves

2021-06-17 – The Central Bank of Ghana will purchase 8.7 tonnes of domestically-mined gold over the next five years to bolster its foreign currency reserves, according to Governor Ernest Addison.

Central banks keep buying

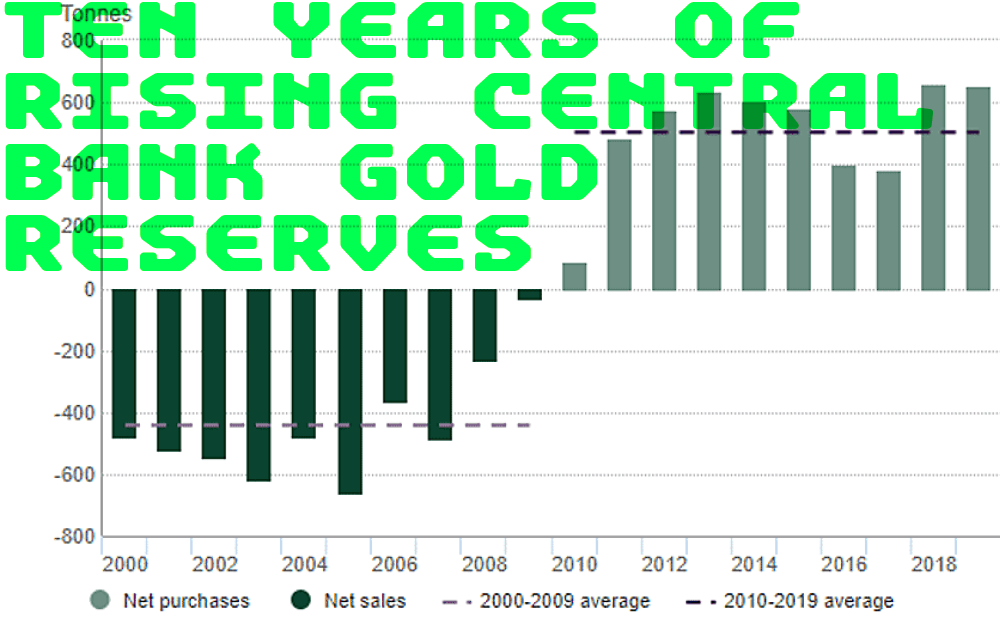

2021-01-31 – Central banks bought more gold bullion last year than any time since 1971, when the U.S. ended the gold standard. Governments added 651.5 tonnes in 2018, a 74 percent increase from the previous year, according to a report from the World Gold Council.

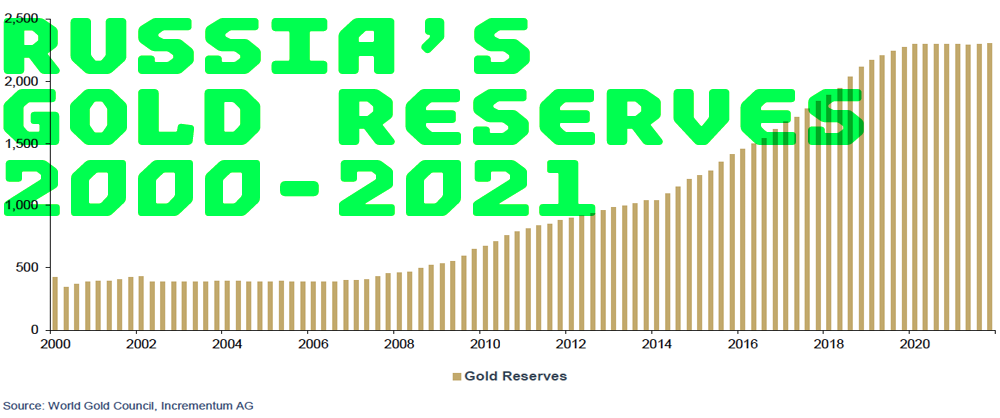

Russia keeps buying

2021-12-19 – The Central Bank of the Russian Federation steadily increased its gold reserves between 2007 and 2018:

Europe removes limit on gold transactions

2019-07-26 – European central banks end a 20 year agreement, saying they have no plans to sell their gold. The Central Bank Gold Agreement (CBGA) was originally signed in 1999 to limit gold sales and help stabilise the market for the precious metal. Through the 1990s, sporadic sales—often conducted behind closed doors by European central banks—drove down prices and undermined the metal’s status as a stable reserve asset. According to the ECB:

“The signatories confirm that gold remains an important element of global monetary reserves, as it continues to provide asset diversification benefits, and none of them currently has plans to sell significant amounts of gold."

Germany repatriates

2016-14-02 – Deutsche Bundesbank completes transfer of their gold from New York. Germany's central bank successfully transferred gold reserves from New York. "The relocation of 300 tonnes of gold from New York to Frankfurt, was fully completed", said Carl-Ludwig Thiele, Member of the Bundesbank’s Executive Board.